Supporting and enabling growth

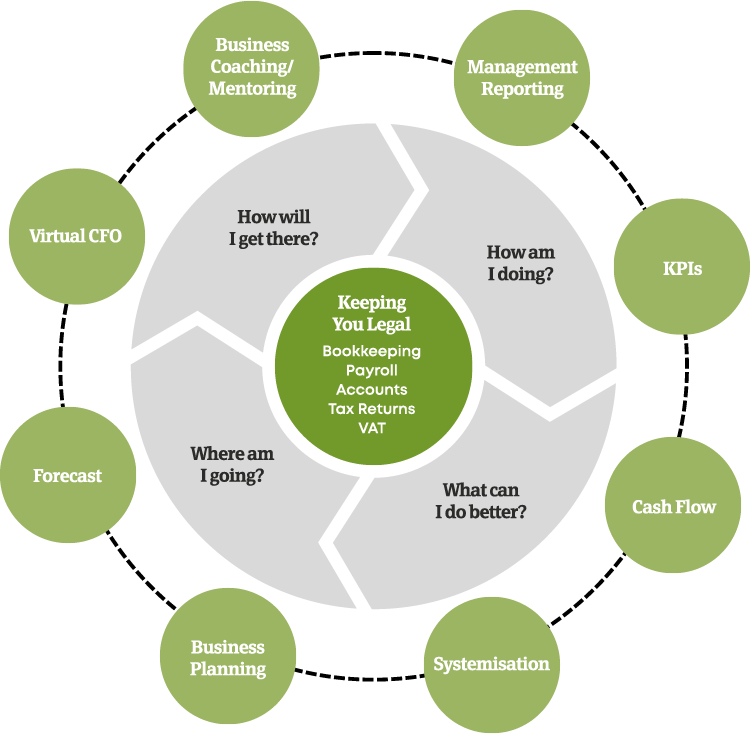

At Beansprout we combine traditional accountancy services with expert coaching to give you financial clarity, increase your confidence, plan for your future and implement solutions to achieve your goals.

Our flexible, scalable approach allows us to offer the services you need now and in the future in the following key areas:

Accounting and Tax Services

We work with self-employed and limited companies to provide the following services:

- Bookkeeping

- VAT services – including Making Tax Digital (MTD)

- Payroll

- Management accounts and ratio analysis

- Statutory accounts and CT600

- Sole Trader Profit and Loss

- Self-assessment tax returns

- Tax planning

- Fully outsourced flexible finance function

Financial Business Coaching

Empowering business owners to use their financial data to analyse, forecast and define their goals – our custom coaching services include the following options:

- Ask an Accountant – Perfect for those not yet ready or able to commit to engaging our services, this option provides up to 60 mins with one of our highly experienced accountants who will answer all your accounting and tax questions.

- Strategy session – From 90-minute to a full day our strategy sessions are tailored to your needs. Led by an experienced accountant and business advisor we can cover any topic linked to your business.

- Business Start-Up Support Package – using 1-2-1 support we guide prospective business owners through all the early financial decisions – from deciding which structure to trade to bookkeeping training.

- Business Finance Masterclass – Tailored to your personal and business requirements this bespoke programme includes 1-2-1 sessions providing practical support, mentoring and accountability to help you grow your business.